![illustrates the time series of the index, tranche [10%, 15%] spreads,... | Download Scientific Diagram illustrates the time series of the index, tranche [10%, 15%] spreads,... | Download Scientific Diagram](https://www.researchgate.net/publication/50413630/figure/fig1/AS:650755912503296@1532163708887/llustrates-the-time-series-of-the-index-tranche-10-15-spreads-CDS-of-IBM-and-Walt.png)

illustrates the time series of the index, tranche [10%, 15%] spreads,... | Download Scientific Diagram

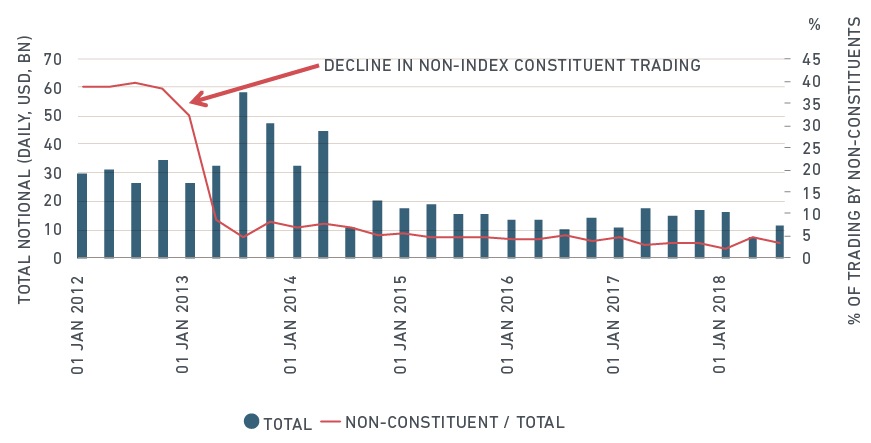

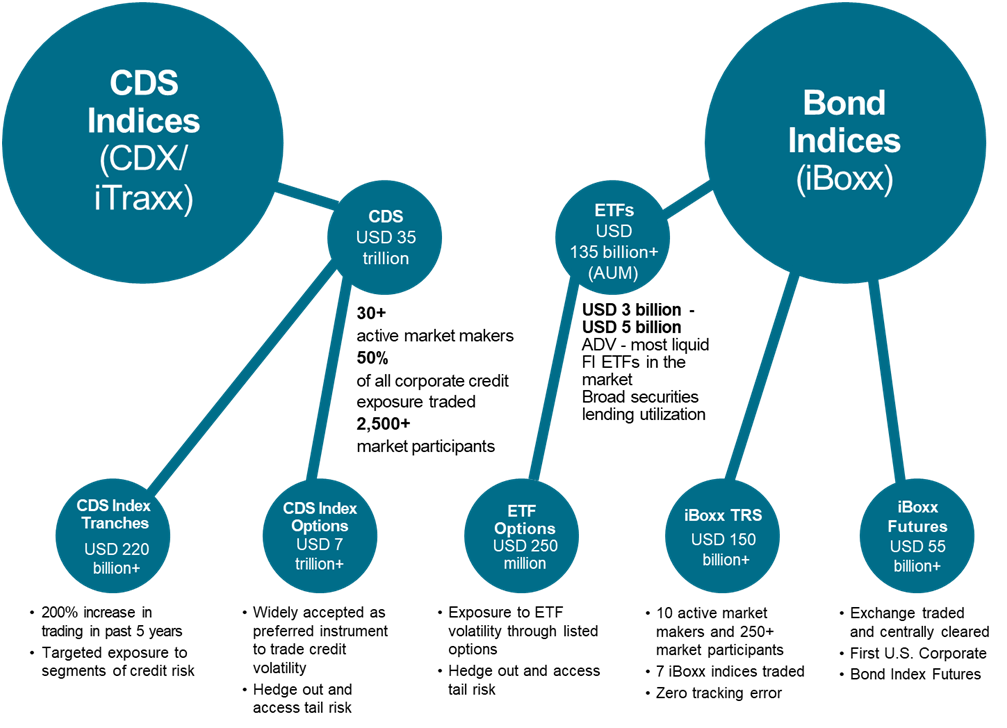

Fixed Income Tradable Ecosystem: North American and European Credit Markets | The World Federation of Exchanges

![Left: 5Y CDX.NA.IG.10 index and tranche [10%, 15%] spreads. Right: 5Y... | Download Scientific Diagram Left: 5Y CDX.NA.IG.10 index and tranche [10%, 15%] spreads. Right: 5Y... | Download Scientific Diagram](https://www.researchgate.net/publication/50413630/figure/fig2/AS:650755912503297@1532163708906/Left-5Y-CDXNAIG10-index-and-tranche-10-15-spreads-Right-5Y-CDS-spreads-of-IBM.png)

Left: 5Y CDX.NA.IG.10 index and tranche [10%, 15%] spreads. Right: 5Y... | Download Scientific Diagram

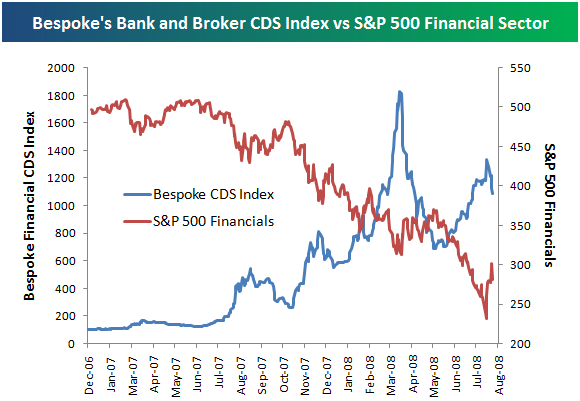

Credit default swap market retrospective: observations from the 2008–9 financial crisis and the onset of the Covid-19 pandemic - Journal of Financial Market Infrastructures