1 Credit Swaps Credit Default Swaps. 2 Generic Credit Default Swap: Definition In a standard credit default swap (CDS), a counterparty buys protection. - ppt download

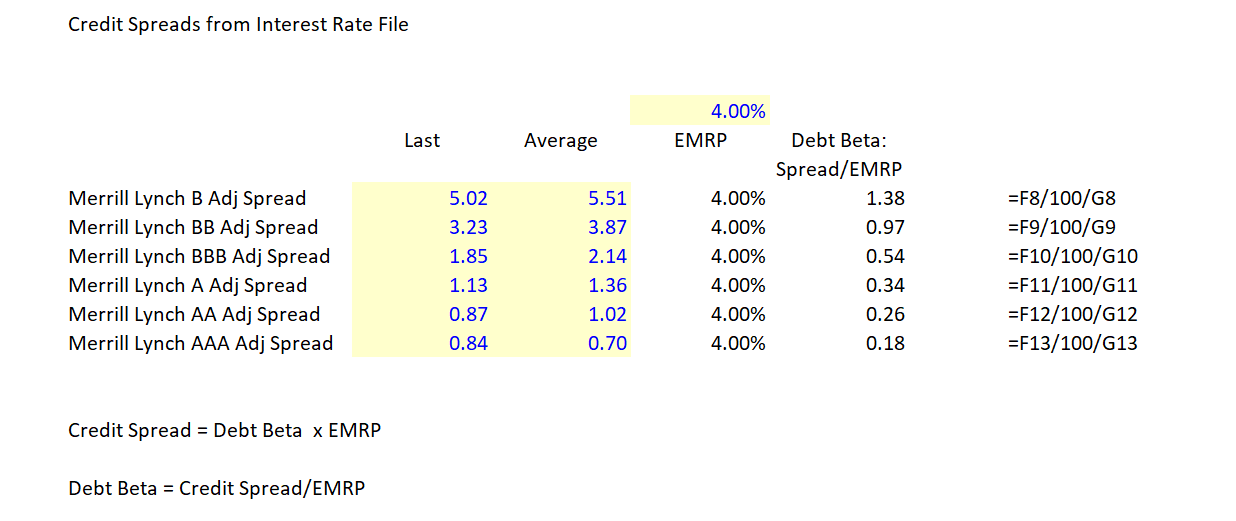

Debt Beta from Credit Spreads Rather than Assuming Zero Debt Beta – Edward Bodmer – Project and Corporate Finance

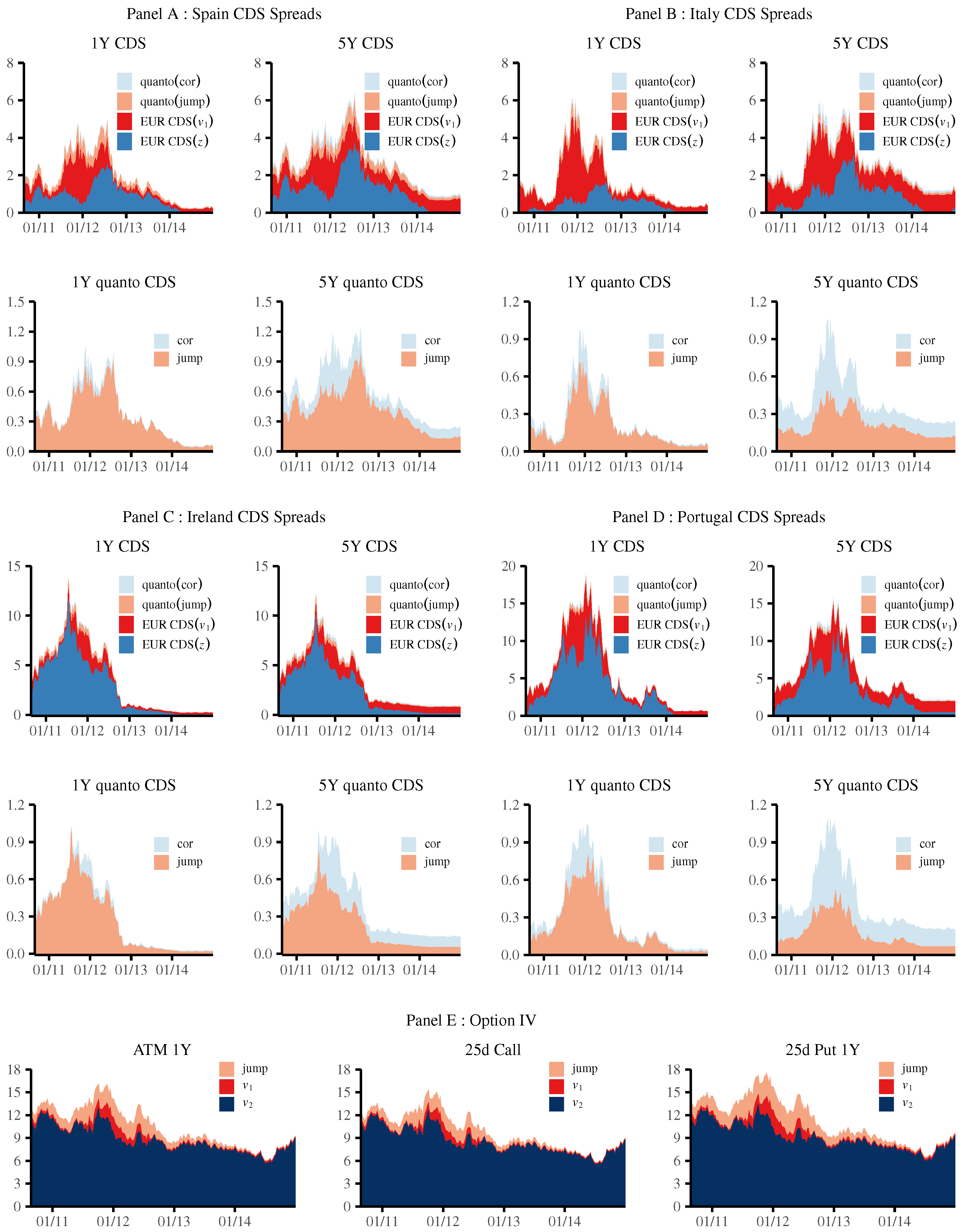

JRFM | Free Full-Text | Interaction between Sovereign Quanto Credit Default Swap Spreads and Currency Options

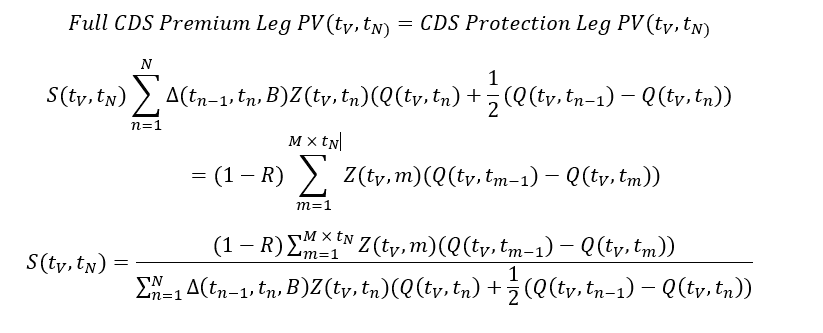

Ming Zhao on X: "4/ How are CDS swaps priced? TLDR: Price (aka "premium") of a CDS is determined by setting buyer expected value (EV) equal to seller EV and solving the